Paycor is a cloud-based payroll software that currently serves over two million users across 40,000 different businesses. Paycor has a website login as well as a mobile app for on-the-go use. While Paycor is known for its payroll functionality, it also includes human capital management tools as part of its upgraded pricing plans.

SEE: Finding the best payroll software for your business can be easy with this list.

Paycor fast facts [3.4 stars]Pricing: contact Paycor for a custom quote Key features:

|

Jump to:

Paycor pricing

On its website, Paycor publicizes four plans for small businesses with less than 50 employees, but does not disclose the pricing for each one. Businesses with more than 50 employees will also need to contact Paycor for a custom quote. A 14-day free trial is available so you can try before you buy.

Paycor Basic Plan

The Basic plan includes classic payroll features such as wage garnishments, off-cycle payruns, online check stubs and online reporting.

Paycor Essential Plan

In addition to all the features offered in the Basic plan, the Essential plan includes a month-end accounting package, a general ledger report, a time off manager, e-verify service and more.

Paycor Core Plan

In addition to all the features offered on the Basic and Essential plans, the Core plan includes expense management, an HR support center and on-demand one-on-one guidance from an HR professional.

Paycor Complete Plan

In addition to all the features offered in the Basic, Essential and Core plans, the Complete plan includes career management, compensation planning and talent development functionality.

Key features of Paycor

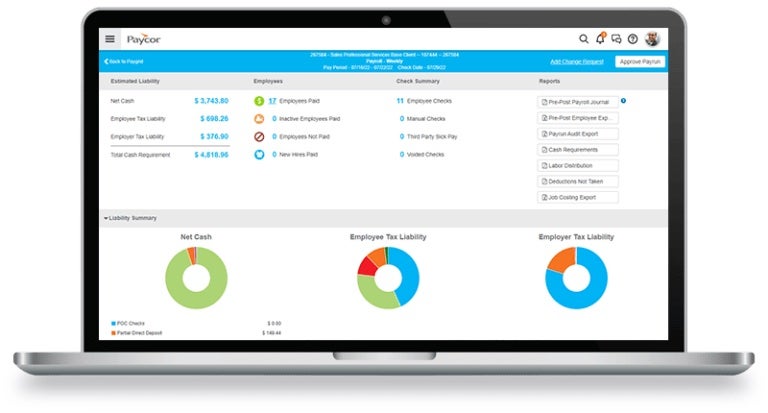

Payroll and tax features

Paycor’s payroll and tax features include federal and state tax filing, direct deposit, check stuffing, employee self-service and new hire filing. You can also set up the AutoRun feature to process payroll on a specific day and time even if you won’t be at the computer that day. All changes are made in real-time, so you don’t have to wait for calculations to process, which speeds up payroll.

These comprehensive payroll features will satisfy most small and medium size businesses, though they might not be robust enough for enterprise businesses with very complex payroll needs.

Time management features

Time tracking is closely tied to payroll, and Paycor allows you to do both within the same system. The time management feature lets you track hours worked and manage time-off requests with automated timekeeping. Employees can clock in and out in the Paycor app, and the mobile app verifies location to prevent time theft when clocking in and out

The software also offers a scheduling feature that allows you to assign shifts and view the entire team’s schedule at a glance. Together, these time tracking and scheduling features eliminate human error and duplicate data entry, leading to a more accurate payroll.

SEE: It would be a sin to miss these top seven church payroll services.

HR and benefits features

If your HR department dreads open enrollment, Paycor’s more advanced plans can help streamline the process thanks to automated workflows. The platform also offers EDI connections that deliver enrollment data to nearly all major insurance carriers. Meanwhile, pay-as-you-go automatic insurance payments ensure that you stay on top of workers’ compensation throughout the year.

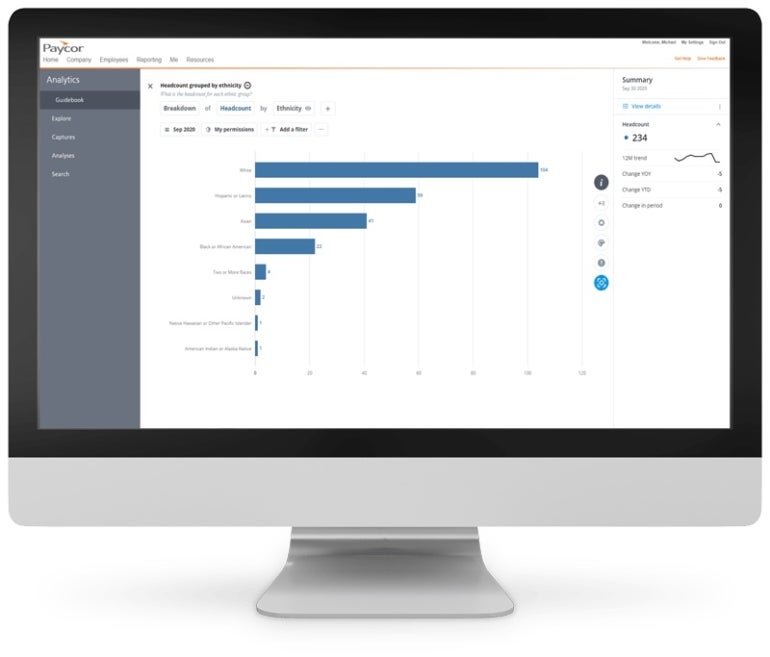

Reporting and analytics

Paycor’s analytics module lets you analyze the composition of your staff by age, gender and ethnicity. You can further sort the data by department, job type or location for additional insight. Users can also visualize and share this data by importing it to 30+ standard reporting templates or designing their own custom report. These analytics and reporting features help your team evaluate pay practices benchmarking against competitors and make strategic business decisions based on data.

Paycor pros

- Multiple paid plans to suit different budgets.

- Unlimited payroll runs.

- Automated payroll.

- Custom reporting.

- Self-service employee portal.

- Mobile app.

Paycor cons

- Pricing structure not transparent.

- More expensive than many other payroll competitors.

- Additional fees for certain payroll actions like check stuffing.

- Lacks a few key integrations like QuickBooks.

- Time tracking is an add-on.

If Paycor isn’t ideal for you, check out these alternatives

Rippling

If you were interested in Paycor not just for its payroll functionality but also for its HCM features, then Rippling is definitely worth checking out. Rippling’s entry-level payroll plan, Unity, costs $35 per month plus $8 per employee per month. Many additional HR features are available — including talent management, learning management, benefits administration, and time and attendance — but you’ll need to request a custom quote to reveal the pricing. Rippling also offers finance and IT management tools that Paycor does not.

Check out our review of Rippling for more information.

Gusto

Gusto is a popular platform that combines easy-to-use payroll with basic HR features like time & attendance and limited onboarding support. Gusto has a Simple pricing plan that starts at $40 per month plus $6 per employee per month — significantly more affordable than even the Basic Paycor plan. However, you will need to upgrade to the Plus or Premium plans if you want access to all the HR features. Gusto integrates with QuickBooks online, whereas Paycor does not.

Get more details in this review of Gusto.

OnPay

If you are mostly looking for payroll and think Paycor might be more complex (and expensive) than you need, give OnPay a look. OnPay only offers one simple pricing plan, $40 per month plus $6 per employee per month. Its payroll features are complemented by basic HR and benefits tools, like PTO management and integrated 401(k) retirement plans. It’s not as comprehensive as Paycor and other competitors, but it’s all that many small businesses will need at one affordable monthly price.

Read our OnPay review to learn about important features, pricing, alternatives and more.

Review methodology

To write this review, we took a guided online tour of Paycor and also viewed demo videos of various features. We also reviewed reputable rankings, customer ratings, testimonials and other expert reviews from credible sources.